Insurance Participation

New York Plastic Surgical Group physicians are in-network providers with the following health plans unless otherwise noted.

- 1199

- Aetna

- Blue Cross Blue Shield

- Cigna

- Elderplan

- Fidelis

- Emblem

- HealthFirst

- Magnacare

- Medicare

- Medicaid

- Molina Healthcare

- NYSHIP/United Healthcare Empire Plan

- Oscar

- Oxford

- United Healthcare

- United Healthcare Community Plan

- Worker’s Comp**

**Dr. William Samson does not participate

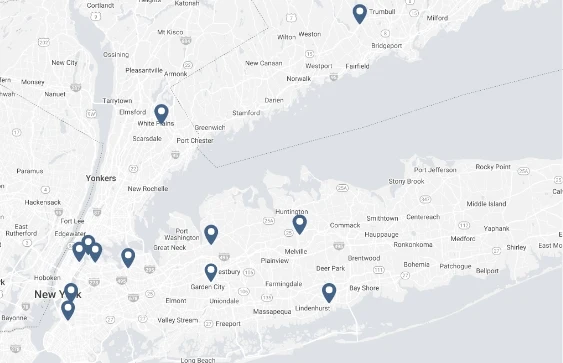

Our physicians are contracted to be in-network providers with a variety of health plans. A full list of these plans and the physician’s respective hospital affiliations can be found here.

- Garden City

- Babylon

- East Hills

- Huntington

- Manhattan

- Brooklyn

- Flushing

- Westchester

- Connecticut